Congratulations! You’ve just downloaded the Free Business Startup Guide Template. This guide will walk you through customizing it step-by-step, turning this powerful 12-page outline into a plan that reflects your unique business vision.

Let’s get started!

What You’ll Need:

- Your free Canva account.

- Your business logo (if you have one).

- Basic information about your business idea, target market, and team.

Step 1: Global Customization – Branding Basics

First, let’s update the template with your unique brand identity for consistency across all pages.

a. Add Your Logo

Locate the “Your Logo” placeholder on the cover page (Page 1) and replace it with your own logo file.

b. Change Brand Colors

Quickly update the main colors (like the accent colors used in headings and shapes) to match your brand. Use Canva’s ‘Styles’ feature or select elements individually and use the color picker.

c. Update Fonts (Optional)

If you have specific brand fonts, apply them using the ‘Styles’ tab or by selecting text boxes individually.

Step 2: Customizing the Cover Page (Template Page 1)

Make the cover specific to your project. Update the following text fields: BUSINESS NAME, YEAR (if needed), PROPOSED BY: [Your Name/Company], and DATE. You can also replace the background image if desired.

Step 3: Editing the Introduction (Template Page 2)

Define the purpose and scope of your plan on this page. Replace the placeholder text (e.g., BY: TSJMAKEOVERS) with your details. Rewrite the purpose statement and the key focus areas (Business Goals, Market Research, etc.) to match your specific business venture.

Step 4: Executive Summary (Template Page 3)

This is a high-level overview of your business. Replace the sample text with your own information.

Update the BRAND OVERVIEW, KEY METRICS (both labels and numbers like 2M+, $50M), and INVESTMENT HIGHLIGHTS sections.

Step 5: Team Profile (Template Page 4)

Showcase the key people involved in your venture.

Replace the placeholder photos with images of your team members. Update the NAME, TITLE, Key Achievements, Previous Companies, and Education for each person. Focus on relevant experience.

Step 6: Market Analysis (Template Page 5)

Provide context about the market you’re entering. Replace the sample data with your research.

Edit the introductory text describing the market. Update the bullet points under Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) with your specific estimates and rationale.

Step 7: Core Marketing Strategy (Template Page 6)

Outline how you plan to reach your customers.

Edit the introductory text. Update the descriptions for each MARKETING CHANNEL (e.g., Paid Advertising, Content Marketing). Adjust the labels and percentages on the PIE CHART using Canva’s chart tools to reflect your budget allocation.

Step 8: Financial Overview (Template Page 7)

Detail your funding needs and how funds will be used.

Edit the FUNDING REQUIREMENTS introductory text. Update the TABLE with your specific Expense Categories, Estimated Costs, Percentages, and Descriptions. Adjust the labels and values on the BAR CHART using Canva’s chart tools to match your table.

Step 9: Project Timeline (Template Page 8)

Outline your key milestones and progress.

Update the text for each milestone (Q1, Q2, Q3, Q4), including the main title (e.g., Foundation & Market Expansion), the description (e.g., Finalize funding round...), and the Status (e.g., Completed, Current). Adjust the final summary text as needed.

Step 10: Metrics Dashboard (Template Page 9) & LTV:CAC Model

Track your Key Performance Indicators (KPIs).

Update the TABLE with the relevant Metrics, Current numbers, Target goals, and comparison Vs. Last Period. Adjust the visual progress bars/elements below the table to reflect your current status towards the target goals.

BONUS: Understanding Your LTV:CAC Ratio

Included with this guide is a simple model to calculate your Customer Lifetime Value (LTV) to Customer Acquisition Cost (CAC) ratio. This is crucial for understanding your business’s profitability and scalability.

The “Health Check” for Your Business Engine

Think of your business as an engine. You spend money (fuel) to get customers, and those customers generate profit (power) over their lifetime. The LTV:CAC ratio is the gauge that tells you exactly how efficiently that engine is running. Get this right, and you have a roadmap for sustainable growth. Get it wrong, and you’re flying blind, likely burning cash faster than you earn it.

Here’s the simple breakdown.

1. Customer Acquisition Cost (CAC)

What it is: Your CAC is the total, all-in cost to acquire one new paying customer.

The Common Mistake: Most people only count ad spend. A top-tier analysis includes everything you spent to get that customer:

- Marketing and advertising spend

- Sales team salaries and commissions

- Software/tools for your sales and marketing teams

- Agency fees, creative costs, etc.

Simple Formula: Total Sales & Marketing Costs / # of New Customers Acquired

Why it Matters: This is your “cost of entry.” It’s the price you pay to get someone in the door. You must know this number.

2. Customer Lifetime Value (LTV)

What it is: Your LTV is the total profit (not just revenue) you expect to earn from an average customer over their entire relationship with your business.

The Common Mistake: Using revenue instead of profit. A $1,000 LTV from a software subscription (90% profit margin) is vastly different from a $1,000 LTV from an e-commerce product (20% profit margin). You must use Gross Margin LTV to know the actual cash that customer contributes to your business.

Simple Formula: (Average Purchase Value x Average Purchase Frequency) x Average Customer Lifespan

Why it Matters: This is the “value” you get from that customer. It tells you what a customer is worth to you, which in turn dictates how much you can afford to spend to get one.

3. The Golden Ratio: LTV:CAC

This is where it all comes together. The LTV:CAC ratio (simply LTV ÷ CAC) is the most important metric for understanding the long-term health and scalability of your business.

It answers one critical question: “For every dollar I spend to get a customer, how many dollars of profit do I get back?”

Here is how to read your ratio:

- 1:1 Ratio (LTV:CAC):

DANGER. You are losing money. For every $1 you spend, you only get $1 back… eventually. This doesn’t even cover your other costs like product development, support, or overhead. This is an unsustainable business model.

- 3:1 Ratio (LTV:CAC):

THE GOLD STANDARD. This is the target for most healthy, venture-backed businesses. For every $1 you spend, you get $3 in profit. This $2 margin is what pays for all your other business operations (R&D, G&A) and leaves room for actual, scalable profit.

- 5:1+ Ratio (LTV:CAC):

EXCELLENT… with a catch. You have a highly efficient and profitable business. However, this high of a ratio might mean you are under-investing in growth. You have room to spend more on CAC to acquire customers faster and capture more of the market before a competitor does.

In short, your LTV:CAC ratio tells you if your growth is profitable and how aggressively you can (and should) hit the accelerator.

Our free template includes a LTV to CAC ratio calculator. You can quickly get a view of your LTV to CAC by following these 3 simple steps.

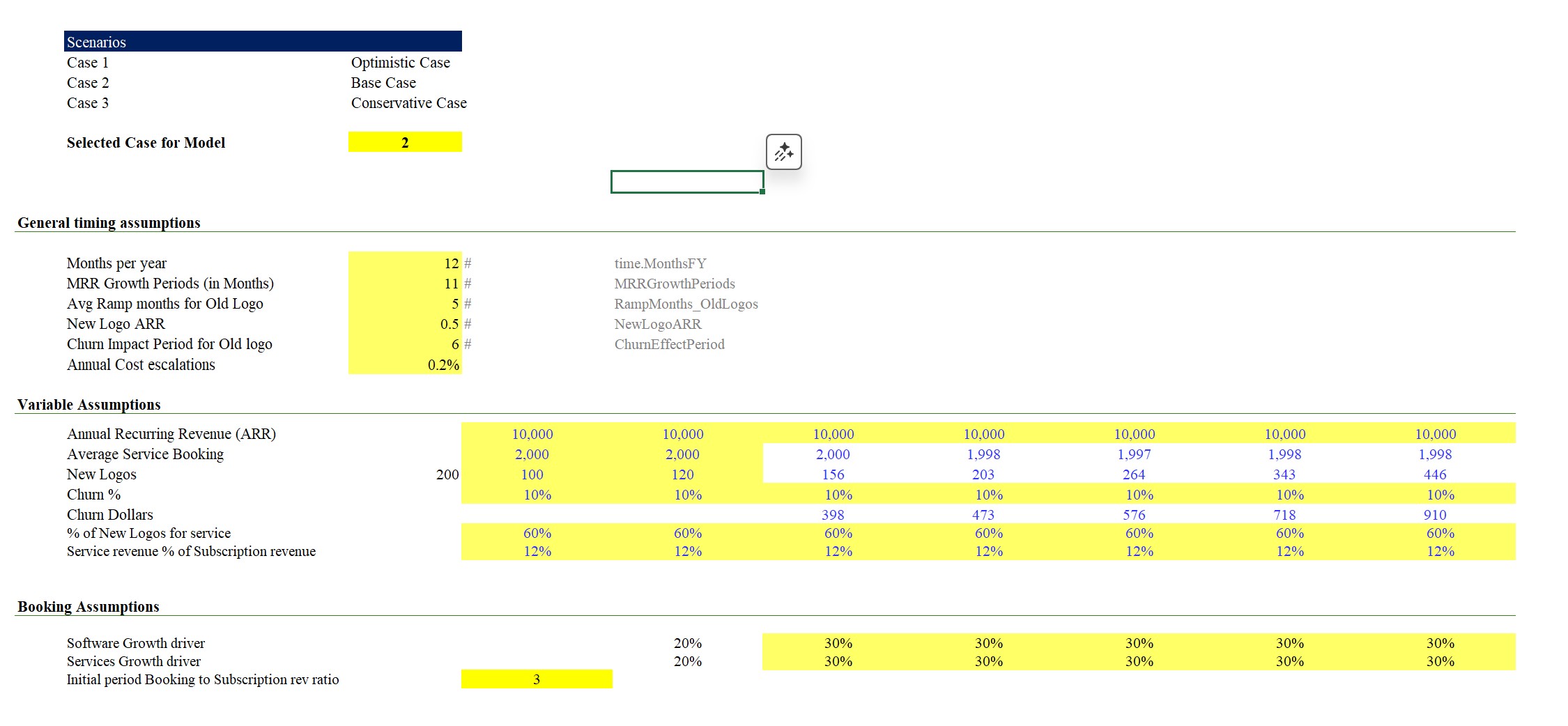

Step 1: After downloading the model, navigate to the Inputs Tab. This is the only tab you need to edit.

Step 2: Enter Your Assumptions: Fill in the cells with the yellow background. Use the definitions below as a guide for each metric.

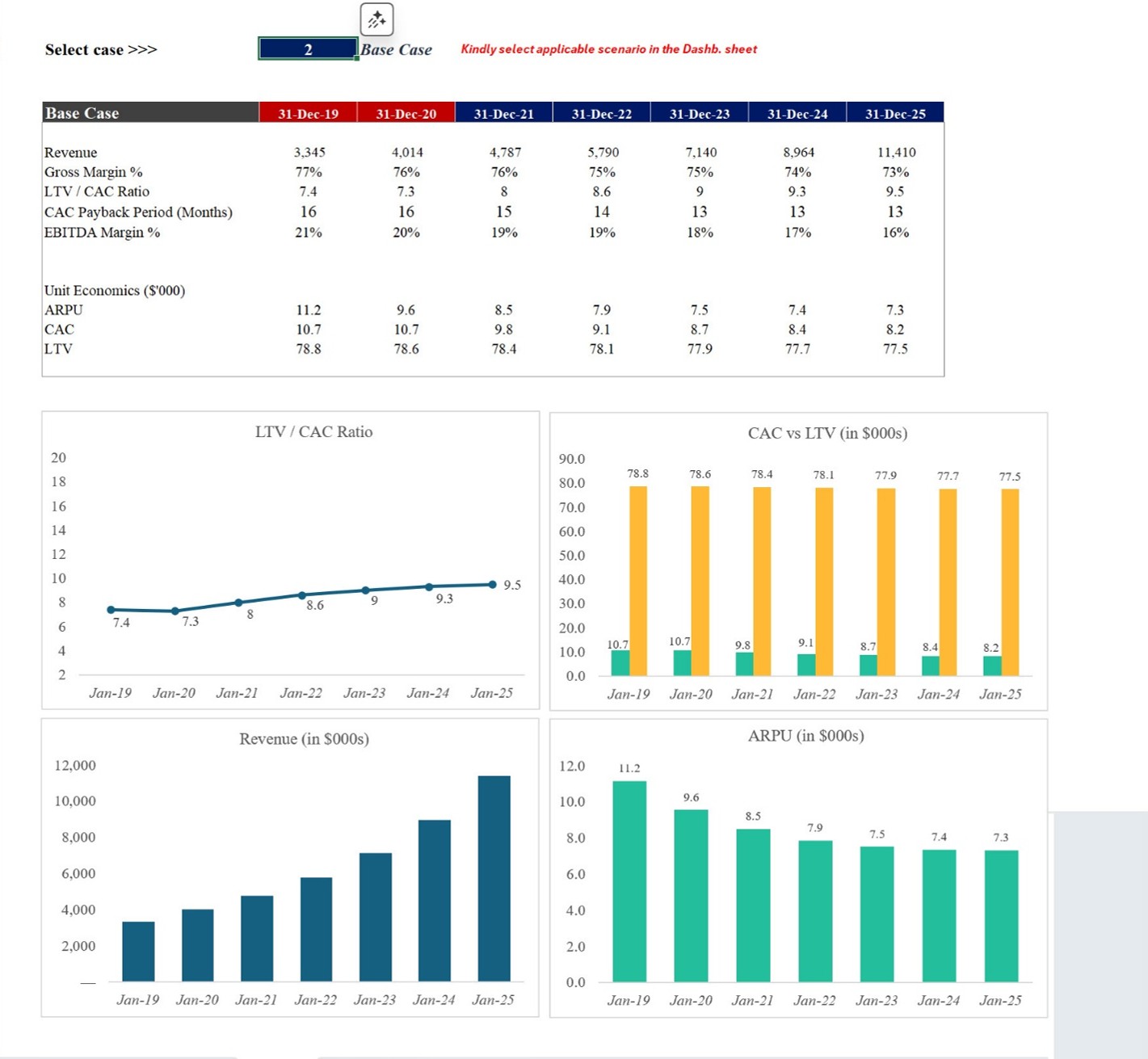

Step 3: Review Your Results. Go to the Dashboard tab to see your key metrics and charts, which will update automatically.

Step 11: Product/Service Overview (Template Page 10)

Clearly define what your business offers.

Replace the placeholder images with visuals relevant to your products/services. Edit the introductory text (WHAT WE OFFER). Update the service titles (e.g., SOCIAL MEDIA MARKETING) and the WHY CHOOSE US bullet points.

Step 12: Customer Analysis (Template Page 11)

Define your ideal customer.

Replace the placeholder text for Business Size, Industry Focus, Key Decision-Makers, Pain Points, and Primary Needs with details about your specific target audience.

Step 13: Contact Page (Template Page 12)

Make it easy for people to connect with you.

Update the EMAIL, PHONE, and ADDRESS details. Customize the final call to action section, including the Next Steps bullet points, to be relevant for your business (e.g., Book a Call, Visit Website, Follow Us).

Ready to Secure Funding & Build a Bulletproof Plan?

You’ve successfully customized the 12-page starter framework – fantastic first step! You now have a solid foundation for your business idea.

However, when you’re ready to create the truly comprehensive, investor-ready document that digs deep into financial projections, detailed market positioning, and operational strategy, you’ll need the complete toolkit.

The Premium 52-Page Business Plan Template instantly adds:

- Detailed Financial Projection Tables (Income Statement, Cash Flow, Balance Sheet)

- In-Depth Competitor Analysis Layouts

- Investor Pitch Deck Specific Slides (Problem, Solution, Traction, Ask)

- Expanded Marketing & Sales Strategy Sections

- Operations Plan, Management Team Bios & More

If you want to save hundreds of hours and access a full library of professionally designed pages built specifically for securing funding and guiding growth, the premium version is your essential next step.

>> Upgrade to the Complete Investor-Ready Business Plan Template <<

You’re Building Something Great!

Whether you stick with the starter kit or upgrade, you now have a clearer vision for your business. Congratulations on taking this crucial planning step!